Get In Touch

Cloud Accounting

Please fill in your details below and one of our consultants will be in touch within the next 24 hours.

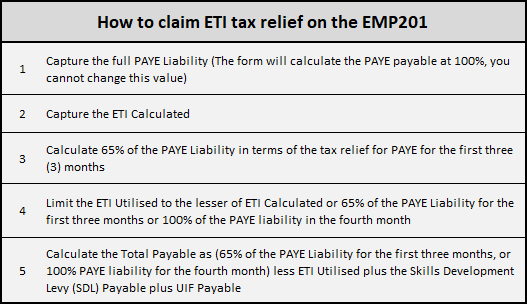

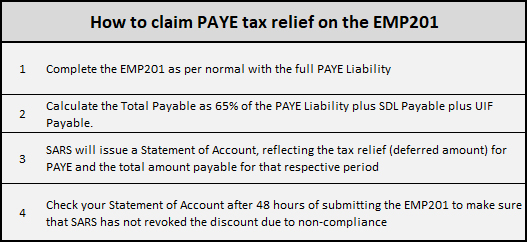

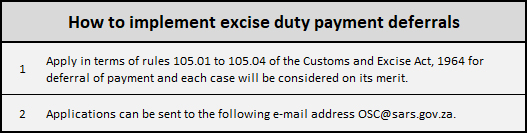

“SARS will implement these tax relief measures because compliant taxpayers have paid their fair share of tax, making it possible for government to provide such a temporary safety net in a time of extreme difficulty” (SARS)

Battered by national lockdowns of varying intensity since March last year, many businesses have been further affected by weeks of looting and riots in July. These cost 330 South Africans their lives, while our country lost about R50 billion in output, with an estimated 50,000 informal traders and 40,000 businesses affected, placing 150,000 jobs at risk.

For some businesses who had managed to survive in an economy that contracted by 7% last year, it was a final blow. In the economic hubs of Gauteng and KwaZulu-Natal, businesses, shops and warehouses were destroyed or shut down. Virtually all businesses across the country – and in neighbouring countries – were impacted by the resulting food, fuel and medical supply shortages, as well as disruption of supply chains when the ports of Durban and Richards Bay were brought to a standstill and the N3 highway was closed.

While these tax measures introduced for employers may be a lifeline for some companies to survive, all businesses are well advised to call on the advice and assistance of their accountant, both when carefully considering the decision to take up this tax relief and in claiming the tax relief. |

Get In Touch

Please fill in your details below and one of our consultants will be in touch within the next 24 hours.