Get In Touch

Cloud Accounting

Please fill in your details below and one of our consultants will be in touch within the next 24 hours.

“Few of us ever test our powers of deduction, except when filling out an income tax form.” (Laurence J. Peter)

In this article, we look at the who, how and when of this 2022 Tax Season; highlight some issues that require special attention; and suggest practical next steps to help you avoid the last-minute rush, the risk of errors and omissions, and the cost of late submissions, penalties and audits.

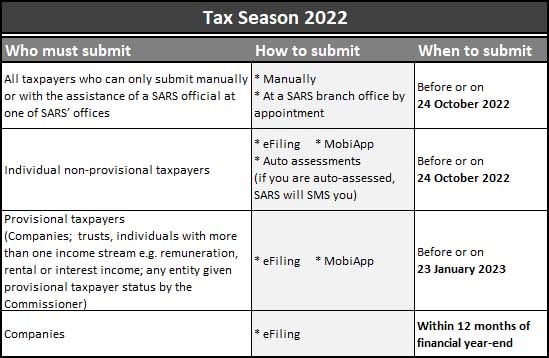

Tax Season 2022 opens 1 July 2022 – here is a quick overview of who must submit, how they must do so and when by:

Even if you could be exempt at first glance you might still benefit from filing a return due to your particular circumstances. If there is any doubt, professional advice is essential.

If you don’t agree with the automated assessment, an accurate ITR12 tax return can be filed within 40 business days of the date of the auto assessment. If this return is filed after 24 October, it will be subject to normal late submission admin penalties and interest. If SARS accepts the changes, a reduced or additional assessment will be issued. If not, the normal objection and appeal options are available.

|

Get In Touch

Please fill in your details below and one of our consultants will be in touch within the next 24 hours.