Get In Touch

Cloud Accounting

Please fill in your details below and one of our consultants will be in touch within the next 24 hours.

“The only thing that hurts more than paying an income tax is not having [an income on which] to pay an income tax” (Thomas Dewar)

Provisional tax is not a separate tax but rather a method of payment used to collect in advance some of a taxpayer’s income tax payable for the year. SARS calls it “an advance payment of a taxpayer’s normal tax liability” and notes in its External Guide for Provisional Tax that provisional tax liability “will prevent a large amount of tax due by you on assessment, as your tax liability will have been spread over a period of time prior to the issue of such assessment”.

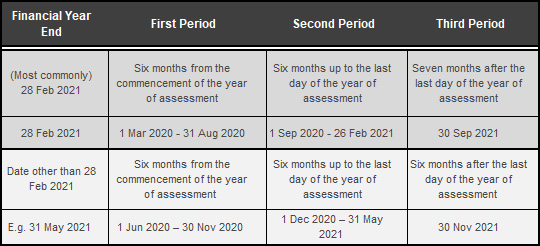

Two provisional tax payments are compulsory each year, one six months into the year of assessment (first period) and one on or before the end of the year of assessment (second period). There is also an option to make an additional third or top-up payment, seven months after the end of the year of assessment – unless your year end is anything other than end of February in which event you have only six months for the top-up payment (third period).

The provisional return for the first period is forward-looking, requiring companies to estimate their taxable income for the year ahead and then paying tax on this estimate in advance.

The provisional return for the second period is retrospective, since by the year end there is more certainty regarding what exactly the income for the year was, and the tax payable thereon.

While provisional tax payments spread a corporate taxpayer’s income tax liability over two or even three payments, it also increases a company’s tax risk. It creates additional tax filing obligations such as completing and submitting a provisional tax return (IRP 6) twice per year, as well as increasing the risk of attracting penalties, notably underestimation penalties. Furthermore, researchers have found that provisional tax is the most burdensome tax for small businesses, and that penalties and interest incorrectly raised by SARS are the most onerous aspect thereof.

Given that taxpayers will find themselves under greater scrutiny and subject to more punitive measures from SARS in 2021, here are some important insights regarding what companies should – and should not – be doing to minimise their provisional tax liability and to avoid the hefty penalties and interest that can apply.

For companies with a financial year ending on 28 February 2021, the next due date for provisional tax returns and payments is 26 February 2021, as the last day for submission (28 February) falls on a weekend.

Also remember that if an IRP6 is filed more than four months after the deadline, SARS considers a ‘nil’ return to have been submitted. Unless the company’s actual taxable income is really zero, it will result in the underestimation penalty being imposed, in addition to a late payment penalty and interest.

Furthermore, interest will be levied on the outstanding amount and will continue to accrue until it has been paid in full. The interest is calculated at the prescribed rate, which is the rate of interest fixed by the Minister of Finance by notice in the Government Gazette and is currently 7% – the lowest in 40 years.

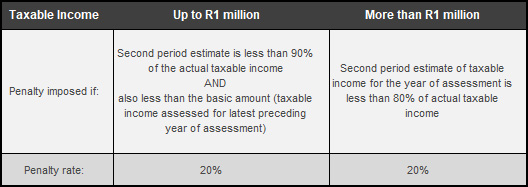

Estimating the annual taxable income just six months into the year is rarely an easy task. Fortunately, under-estimating income for the first period does not attract a penalty, but the second estimate must be quite accurate (within 80 – 90% of the actual taxable income) to avoid the underestimation penalty.

The underestimation penalty is calculated depending on the taxable income, and the percentage of under-estimation as detailed in the table below.

Underestimation penalties

Interest will also be levied on the underpayment of provisional tax as a result of under estimation.

Make certain that all sources of income are included. The estimated taxable income means gross income less exempt income plus all amounts included or deemed to be included in taxable income under the Act, for example, the amount of taxable capital gains.

Ensure that all rebates and amounts allowed to be deducted or set off are also factored in, including provisional payments already made for the year.

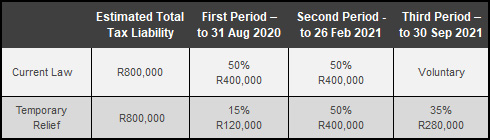

Also make sure, if you claimed for COVID-19 provisional tax relief, that the company qualifies before factoring in this cash flow relief and ensure such relief is calculated correctly.

Government’s temporary provisional tax relief measures came into effect in April 2020 and allowed qualifying taxpayers to defer a portion of the payment of their first and second provisional tax liability to SARS, without SARS imposing administrative penalties and interest on the deferred amounts.

Claiming this provisional tax relief while not meeting the qualifying requirements will result in normal penalties and interest being applied to the provisional account.

Get In Touch

Please fill in your details below and one of our consultants will be in touch within the next 24 hours.